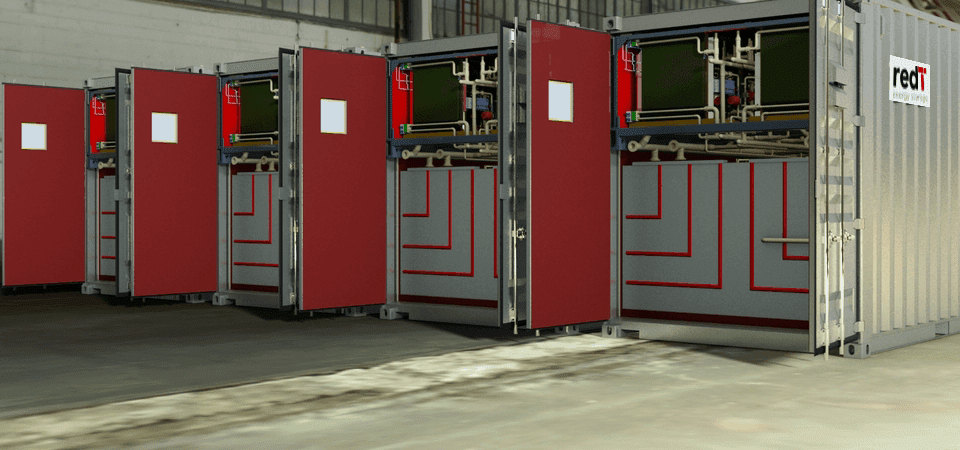

RedT to raise £12m to accelerate growth

Energy storage technology company RedT has conditionally raised £12 million from selling new shares to institutional and other investors to allow it to "aggressively ramp up" its sales and marketing efforts.

13th December 2016 by Networks

The company issued 150,000,000 shares at a price of 8 pence per share. The New Ordinary Shares will represent approximately 28.4% of the Enlarged Share Capital immediately following completion of the Open Offer

RedT said approximately £1.3 million will cover capital expenditure of the development of its Gen 3 storage machines, £2 million will cover the operating costs for Gen 3 and Gen 4 development, and £8 million will be used for sales, operations and working capital for the next 2 years to accelerate pipeline delivery.

Alongside, RedT is proposing an Open Offer to existing shareholders to enable them to participate in the capital raising process at an equivalent price.

This is expected to raise up to £3 million, although the company has said its strategy is not contingent upon a full take-up of the open offer, and any funds received will be additional to the company’s immediate funding requirements.

RedT chief executive Scott McGregor said:”Estimated at $100-$150 billion, the stationary energy storage market presents RedT with a very significant opportunity for sustainable growth and our technology holds the key to unlocking firm renewable power for the future.

“With a strengthened balance sheet, we will now be able to aggressively ramp up our sales and marketing efforts, and continue the development of the future generation of RedT machines.”

Comments

Login on register to comment

Related content

Power

The future for vegetation management

Why networks should focus on data not trees to overcome the costly challenges involved in vegetation management

Power

An unprecedented opportunity for change

Why short interruptions will matter in RIIO-ED2 and how to address them.

Power

Time for less talk and more action on decarbonisation

Core "oven-ready" solutions to decarbonising heat and transport exist today and should be implemented without delay, says WPD's future power networks expert.

Related supplier content

Power

Load patterns and lockdown: how Covid-19 is impacting electricity networks

Insights into dynamics on the low voltage network as the outbreak unfolds

Heat

How E.ON. is helping the City of London become a zero emissions city

Discover Citigen. Deep in the heart of our bustling capital

Power

The Innovation Factor: Managing the transition to smart communication technologies in the electricity distribution sector white paper

The transition from legacy communications systems to new technologies can seem daunting for organisations in the electricity sector. But with market dynamics changing rapidly