Providing a platform

Scottish and Southern Electricity Networks (SSEN) has entered into a partnership with leading software company, Open Utility, to learn from and participate in its revolutionary smart grid platform. Alec Peachey speaks to Steve Atkins (DSO transition Manager for SSEN) and James Johnston (CEO and cofounder of Open Utility) to find out more.

25th June 2018 by Networks

One of the biggest changes in the energy system is the flexibility revolution. Distributed generation, electric vehicles, demand side response and energy storage are transforming the sector, giving customers access to new products and services from a new range of providers. To facilitate the shift to a smarter, flexible energy system, SSEN is transitioning from a distribution network operator (DNO) to a distribution system operator (DSO).

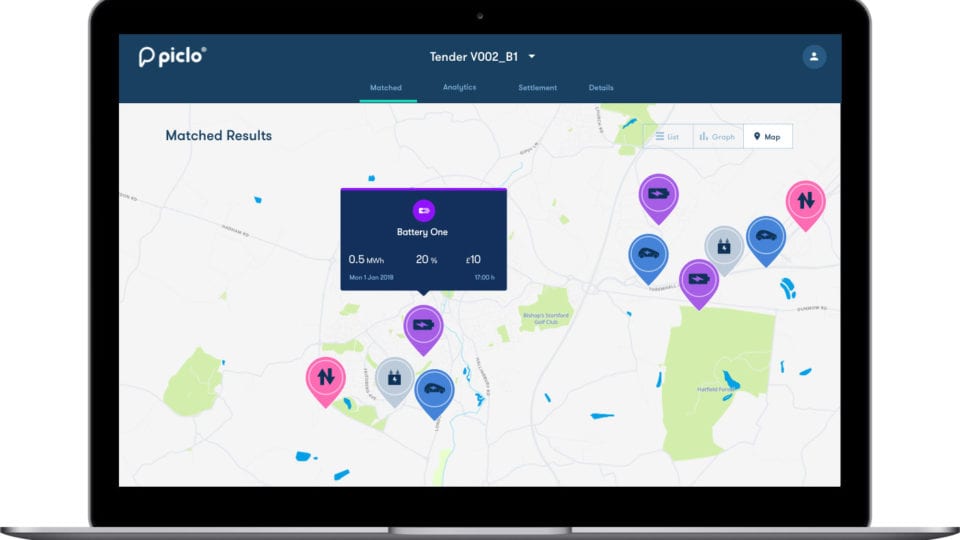

The transition to a DSO will create the potential for new opportunities for energy users through peer-to-peer and flexibility trading, creating new markets where supply and demand can be balanced and traded at a local level. SSEN’s collaboration with Open Utility will see it trial Open Utility’s new ‘Piclo’ platform, which will provide key learnings to help inform SSEN’s ongoing research.

Piclo helps DSOs procure flexible capacity from technologies such as batteries and demand-response aggregators to meet the needs of local electricity users. It is a matchmaking and trading platform for local energy which provides opportunities for customers, generators and other flexibility providers to register their availability and preferences, which the Piclo platform then matches with opportunities from the DSO.

Johnston explains why the provision of flexibility services on electricity distribution networks is so important.

“There are a number of important emerging use cases for DNO flexibility services,” he commented.

“Firstly, deferral of network reinforcement in areas of uncertain demand growth. There are conflicting trends of demand increase (from electric vehicles and electric heat) and demand reduction (renewables and energy efficiency) which means the value proposition of investing in assets becomes less clear and increases the risk that customers lose out through unnecessary reinforcement costs.

“Secondly, the DNOs want more tools at their disposal to manage outages (both planned and unplanned). Being able to manage demand in specific locations of the network at short notice could limit the potential domino effect of blackouts in abnormal conditions.”

Atkins agrees with this view, adding: “Historically, DNOs have resorted to the installation of additional assets (reinforcement) to provide additional network capacity or solve power quality and fault issues. These solutions (paid for by customers through their bills) can be expensive, disruptive, and have the risk of becoming a stranded asset if generation and demand forecasts prove to be inaccurate. We are keen to explore the utilisation of flexible distributed energy resources that can be contracted to provide a lower cost solution to reinforcement.”

Transforming the sector

Johnston described how energy storage and demand-response will help transform the sector in different ways.

“Firstly, it lowers barriers for anyone to participate in providing critical services to the grid,” he remarked. “Secondly, it allows the network companies to get more out of their existing grids. They will no longer need to size networks for the occasional peaks and can rely on peak-shaving to better utilise their networks (and pass savings of avoiding unnecessary reinforcement onto customers).”

With different pressures being put on the grid, balancing supply and demand at a local level is important.

“Many resources now connecting to the distribution network have a greater ability to flex their demand or generation and therefore offer that ability as a service to the DNO or other connected parties,” explains Atkins. “Low carbon technologies on the distribution network allow for energy consumption to be more closely aligned to a source of production; not only can this reduce network losses, it can help avoid the need for high voltage network and generation investment, and it provides opportunities for cost reductions at a local level.”

As a number of distribution network operators continue their transition to becoming DSOs, Atkins points to the work that SSEN is doing in this area.

“We are fully supporting the Open Networks Project (Energy Networks Association initiative), we have a dedicated DSO team that support SMEs across the industry, we have buy-in from senior leaders within the business, and we have already published our Supporting a Smarter Electricity System report. We are now starting to look at trials that explore the opportunities of a smart grid for customers, consider the regulatory incentives that would ensure the right behaviours from DSOs, and consider the least regrets investments.”

Both Johnston and Atkins agree that moves towards a more flexible market have already taken place.

Johnston said: “I see several exciting things happening in the UK market. The most exciting thing in my view is that most DNOs are actually undertaking flexibility procurement exercises this year. This is not blue-sky innovation and is business-as-usual deployment for them.

“This commercial approach resonates with us at Open Utility, as we are building a service that can help DNOs solve real-world problems. For example: how can DNOs find out what flexibility assets are available in specific locations on their network?”

“We have already gone out to the market to secure flexible services in a number of Constraint Managed Zone tenders where distributed energy resources will provide an alternative to reinforcement,” highlights Atkins. “We have a suite of flexible connections products that customers can consider to mitigate the delays or cost associated with reinforcement. We are consulting on an interim solution for managed EV charging that smooths charging in EV hotspots to maintain grid resilience.”

Trading energy

Open Utility will be trialling its local flexibility marketplace, Piclo, throughout 2018 as part of a Department of Business, Energy and Industrial Strategy funded project. The platform will be opening up for a limited number of battery operators and demand-response aggregators to register their assets in late Spring.

But is there an appetite from consumers to trade energy?

“I think householders on the whole will not want to directly engage in markets – they have better things to do than search for arbitrage opportunities, saving £10-20 here or there. I think electricity markets will remain an invisible component in most people’s lives,” Johnston tells Network.

“On the other hand, the consumers’ electricity supplier, or their smart home provider or perhaps even their EV provider will see significant opportunities in aggregating up thousands of homes to optimise the revenue opportunity of those assets. Their job will be in marketing this in a way that engages customers to choose them over a competitor. For example. “install a battery, and get free green electricity”, versus “buy an Alexa smart home, and you can buy your energy from other Amazon prime members”.

For Atkins, it’s about keeping things simple: “If we can develop simple propositions for customers that have clear benefits then we are confident they will be keen to participate.”

Regulation can sometimes play a part in preventing innovators from bringing new products, services and business models to market. So could regulation be a barrier to creating flexibility services?

“Currently, there are no specific regulatory barriers for someone to provide flexibility services to their DNO,” explains Johnston. The UK’s TOTEX (CAPEX or OPEX agnostic) approach to controlling DNO revenue, means that DNOs have a strong incentive to become smarter and transition into distribution system operators (DSOs). As a result, the UK is leading the world with the development of smart grids.”

According to both Open Utility and SSEN, the Piclo platform will unlock new revenue streams for homes, businesses and communities, whilst supporting the continued journey to a low carbon, decarbonised energy system.

“The Piclo Flex Marketplace lowers barriers for both buyers and sellers of flexibility to trade. We see this as a critical barrier to the adoption of DSO flexibility at scale,” comments Johnston. “Traditional bilateral trades have worked so far, since there has only been one effective buyer of flexibility (National Grid) and flexibility has been provided by larger scale sellers. With the emerging requirements of DSO flexibility and in the future peer-to-peer trading, bilateral trading is going to be far too complicated. There is a crucial role of an independent exchange platform, that can simplify, streamline and optimise flexibility transactions – so it works for all participants.”

The last word goes to Atkins: “New platforms will provide visibility of the opportunities available to those able to provide flexibility using distributed energy resources and will facilitate the coupling of DNO requirements with solutions available in the market.”

For further information visit: https://www.openutility.com

Comments

Login on register to comment

Related content

Heat

Electric storage heating – a Cinderella solution

Why has electric storage heating been overlooked as we seek to tackle decarbonising domestic heat?

Heat

Prospects bright for landmark East London Heat Network

New Vattenfall-Cory partnership marks step towards record-breaking heat network capable of serving over 10,000 homes

Heat

New construction director at Switch2 Energy

Appointee brings experience from Vattenfall and Eon

Related supplier content

![‘Learning by doing’ on the road to net zero [test product]](https://networksonline.s3.amazonaws.com/products/images/3.jpg)

People & Skills

‘Learning by doing’ on the road to net zero [test product]

DSO director Andrew Roper discusses 'Learning by doing'

Power

Load patterns and lockdown: how Covid-19 is impacting electricity networks

Insights into dynamics on the low voltage network as the outbreak unfolds

Downloads

Protect electrical equipment from insulation failure

Insulation faults are a major cause leading to the eventual failure of electrical equipment. Partial discharge (PD) is a very reliable indicator of developing insulation faults. Regular PD testing allows users to detect and analyze PD activity